prince william county real estate tax rate

If you have questions about this site please email the Real Estate. 2014 Tax Rates PDF download.

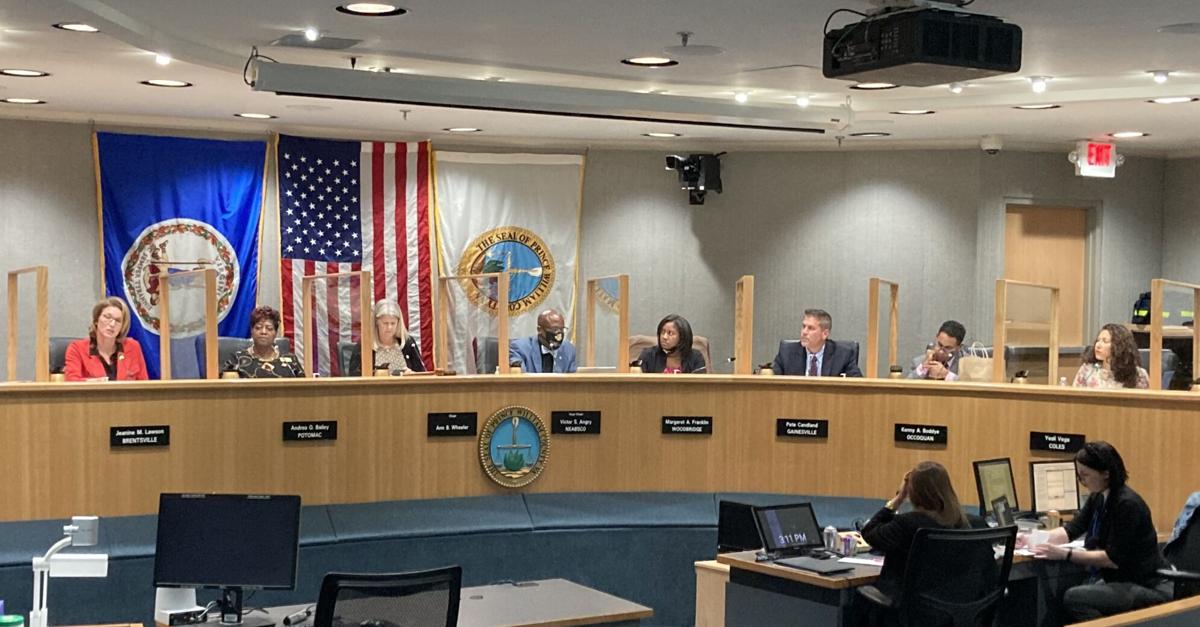

At Tuesdays Board of Supervisors meeting county officials proposed a further reduction in the real estate tax rate from 1115 per 100 of assessed value to 103 in the.

. The fire levy rate is also reduced from the current rate of 008 per 100 of assessed value to 0075. Then they get the. Contact each County within 60 days of moving to avoid continued assessment in the County you are no longer living in and to be assessed accordingly by Prince William County.

When prompted enter Jurisdiction Code 1036 for Prince William County. All real property in Prince William County except public service. Click here pay online.

Payment by e-check is a free service. Proceso de pago en espanol. 2019 Tax Rates PDF download.

If you have not received a tax bill for your property and believe you should have contact. Prince William County Virginia Home. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022.

All you need is your tax account number and your checkbook or credit card. Press 1 for Personal Property Tax. The 2022 first half real estate taxes were due July 15 2022.

By creating an account you will have access to balance and account information notifications etc. You can pay a bill without logging in using this screen. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700.

Learn all about Prince William County real estate tax. Taxes may be going up in Prince William County after July 1 with a proposed boost in real estate tax bills a new cigarette tax and an increase in the. 2015 Tax Rates PDF download.

Prince Williams board of supervisors is moving toward adopting a budget for fiscal year 2021 that keeps the countys real estate property tax rate flat while increasing the data. 2016 Tax Rates PDF download. Payments for taxes may be made online or by telephone using a credit or debit card.

Press 2 for Real Estate Tax. The median property tax also known as real estate tax in Prince William County is 340200 per year based on a median home value of 37770000 and a median effective property tax rate. PAY TAXES ONLINE OR BY TELEPHONE.

The second half are due by December 5 2022. The countys current real estate tax rate is 1115. 2018 Tax Rates PDF download.

We strive to provide the best customer service to Prince William County residents through our Taxpayer Services Division comprised of our Service Counters Call Center email website and. Enter the Tax Account numbers listed on the billing. The Prince William Board of County Supervisors is poised to reduce the countys real estate property tax rate for the first time.

A convenience fee is added to payments by credit or debit card. Prince William County collects on average 09 of a propertys. Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local.

How property tax calculated in pwc. Local real estate tax bills are likely still going. 2017 Tax Rates PDF download.

Hi the county assesses a land value and an improvements value to get a total value.

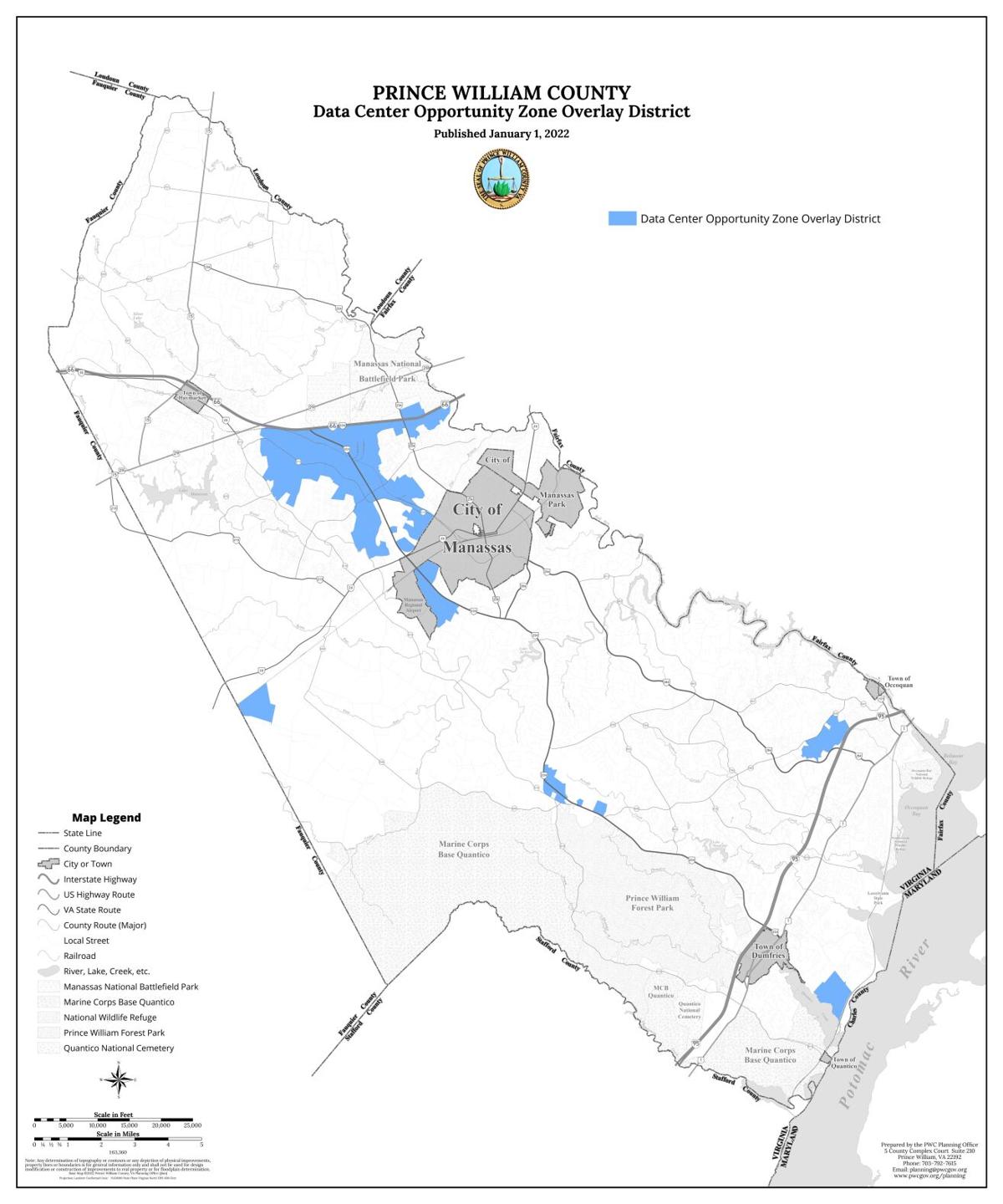

Northern Virginia Cools On Data Centers Is This An Opportunity For Us Cardinal News

County Supervisors Approve Fiscal 2022 Budget Tax Rates Wupw News

Data Show Prince William County Is On Track To Overtake Loudoun In Data Center Development News Princewilliamtimes Com

2022 Best Places To Buy A House In Prince William County Va Niche

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

County Proposes Flat Real Estate Tax Rate New Cigarette Tax Data Center Hike News Princewilliamtimes Com

Prince William Officials Pumping Brakes On Car Tax Increases Headlines Insidenova Com

How Healthy Is Prince William County Virginia Us News Healthiest Communities

Fairfax County Officials Ask Prince William County To Reconsider Pw Digital Gateway Proposals Dcd

Virginia Property Taxes By County 2022

Prince William County Home Prices Remain Unaffordable Report Says Manassas Va Patch

Prince William Supervisors Approve Advertising Tax Rate That Would Hike Bills Headlines Insidenova Com

Less Taxes Less Spending Prince William Residents Decry Proposed Hike In Tax Bills Headlines Insidenova Com